FinTech Software Development: Types, Features & Costs Explained

Quick Summary: Want to enter the FinTech app market with a robust platform? Discover the various types, must-have features, cost of financial software development, and the right FinTech app development company with this blog.

The FinTech industry has become one of the most dominating industries. We all know the reasons. Easy and quick digital payments, the ability to use QR codes, safe financial transactions, and the ability to manage all finance-related data in one software are some of the reasons why people are downloading FinTech apps.

As a startup and small business wanting to enter the finance software industry, you might have a number of questions. What are various types of FinTech apps you can invest in, how do you build FinTech software, what is the FinTech app development cost, and so on?

Don’t worry; we have got you covered. By the end of this blog, you will have answers to all your questions along with how you can get started by partnering with the right financial software development company.

Let’s begin by looking at the types of finance software you can invest in.

Table of Contents

Top 5 Financial Applications Software

Before getting started with the types of FinTech apps, features, and FinTech app development costs, here is the list of the top five FinTech apps that you should consider.

1. Chime

Chime is one of the leading FinTech apps in the US market. It is known for its user-friendly interface and fee-free banking services. It offers various features, such as early direct deposit, automatic savings, no overdraft fee, and access to a large network of fee-free ATMs.

Country of origin: USA

Revenue in 2023: $3.16 billion

App users in 2023: 21.6 million

2. Robinhood

Robinhood is a commission-free trading app that allows users to invest in stocks, ETFs, options, and cryptocurrencies. Its standout features include real-time market data, no minimum account balance, and the ability to trade fractional shares. Robinhood is popular for its easy-to-use interface and educational resources.

Country of origin: USA

Revenue in 2023: $5.6 billion

App users in 2023: 10.8 million

3. Coinbase

Coinbase is a leading cryptocurrency exchange app in the USA. It provides a secure platform for buying, selling, and storing cryptocurrencies like Bitcoin and Ethereum. It offers features such as real-time price alerts, recurring buys, and insured custodial wallets. It also supports advanced trading options through Coinbase Pro.

Country of origin: USA

Revenue in 2023: $3.1 billion

App users in 2023: 89 million

4. Venmo

Venmo is a widely used peer-to-peer payment app that enables users to send and receive money quickly and securely. The app integrates social features with financial transactions, allowing users to share payment notes with friends in a social feed. It offers features such as bill splitting, payments via QR codes, and direct deposits for paychecks.

Country of origin: USA

Revenue in 2023: $2.4 billion

App users in 2023: 60 million

5. Acorns

Acorns is a micro-investment app designed to help users invest and save effortlessly by rounding up their everyday purchases and investing the spare change. Users can create diversified portfolios based on their risk tolerance, and the app handles investment decisions through a set-and-forget approach. Acorns also provides educational content to help users improve their financial literacy.

Country of origin: USA

Revenue in 2023: 309 million

App users in 2023: 6.58 million

Types of Finance Software Startups and Small Businesses can Invest in

The FinTech industry is not limited to only one app idea. There are multiple concepts, each solving a specific problem. Before you begin with the FinTech app development, you must decide upon the perfect idea. Some of the top FinTech businesses include:

a) Banking Apps

The banking app is one of the most popular finance software that allows users to access, manage, and control their finances using mobile devices and web-based solutions. These apps provide several features that enable account balance tracking, bill payment, fund transfers, budgeting tools, and investment management.

Top examples of banking apps are Chase Mobile and Bank of America Mobile Banking.

b) Payment Apps

Another idea you can consider for your FinTech app development is payment apps. Such applications allow users to receive and send money through one platform. These apps make it quick and easy to make payments for goods and services. Some apps also allow for additional features like splitting cash with friends, sending money out of the country, and so on.

Top examples of payment apps are Venmo and Zelle.

c) Investment Apps

Did you know that the digital investment market is expected to grow to US$3,409 billion by 2028? Hence, building an investment app is another great finance software idea. Investment apps allow users to buy and sell stocks, bonds, and other financial assets through the platform. Further, they can track investments and manage portfolios seamlessly with the app.

Top examples of investment apps are Robinhood and Acorns.

d) Lending Apps

Another popular FinTech app is the lending app. These applications facilitate borrowing processes, helping users obtain loans quickly and conveniently. They are also known for streamlining loan applications, leveraging technology for credit assessment, and accelerating fund disbursement. Lending apps provide faster solutions compared to traditional banks.

Top examples of lending apps are EarnIn and Brigit.

e) Insurance Apps

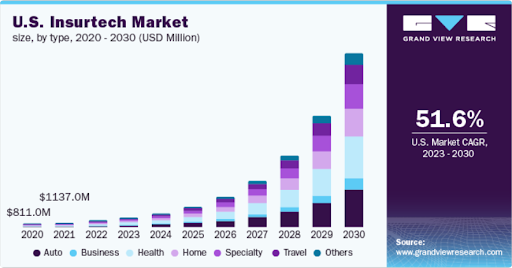

Insurance apps are another widely used FinTech application. According to reports, the US Insurtech market is set to witness rapid growth.

Source: Grand View Research

Many startups have invested in insurance apps that provide their customers with low premiums, longer payment times, automated claim processing, and many more features. These apps are widely used as they enable users to manage their insurance policies, file claims, track policy information, and access customer support conveniently.

Top examples of insurance apps are Geico Mobile and Progressive

f) Blockchain and Cryptocurrency Apps

Blockchain and cryptocurrency apps are digital platforms that utilize blockchain technology to enable secure transactions, digital asset management, and decentralized financial activities. They provide users with tools for cryptocurrency trading, wallet management, blockchain network interaction, and secure access to the broader blockchain ecosystem, fostering financial inclusion and innovation.

Top examples of blockchain and cryptocurrency apps are Coinbase and Gemini.

What is the Cost of Financial App Development?

When it comes to FinTech app development, considering the cost is crucial for startups and small businesses. On average, the cost ranges between $50,000 and $1,00,000. This cost further varies depending on app features, design, development time, and many other factors.

Further, the cost for different types of FinTech apps requires different features, functionalities, and customizations. Hence, the development price for each FinTech app development would be different.

Want to build FinTech software for your business? Check our complete guide on FinTech app development to understand the process.

Features that Make a FinTech App Engaging and Useful

During the FinTech app development process, considering the right app features and functionalities is critical. It is through these features that you will be able to provide solutions, engage new users, and retain existing customers.

Here is a complete list of the necessary features:

User-Friendly Interface

First and foremost, ensure that your FinTech app is user-friendly. It should include intuitive navigation, a clear design, and some options to customize the app according to the user’s preferences.

Secure Authentication

Secure authentication is one of the major concerns in FinTech applications. It involves implementing advanced security measures like biometric authentication and two-factor authentication to prevent sensitive financial information.

Comprehensive Dashboard

Building a successful FinTech software requires creating an engaging dashboard. The dashboard will help users track their income, expenses, latest market updates, transactions, and much more.

QR-Code Payment

The QR code feature in the finance software is one of the fastest payment methods. As per the reports, 84% of mobile users scanned a QR code at least once. Hence, adding this feature will enhance the user experience.

Push Notifications

Push notifications in the FinTech apps provide instant updates on transactions, security alerts, account changes, and promotional offers. These notifications not only keep the users informed but also enhance user engagement.

Third-Party Integrations

Third-party integration enables smooth connectivity with external services like payment gateways and financial data providers. These integrations further help in enhancing functionality and service offerings, extending the app’s capabilities.

Blockchain FinTech Solutions

Blockchain technology in FinTech apps helps store data securely, track and manage digital identification information, and minimize the risk of personal data leakage.

Personalized Experience

Personalization in apps always helps in growth. During FinTech application development, make sure that you design features and functionalities that provide a personalized experience to users.

Fraud Detection

Safeguarding users’ personal and financial information in the FinTech apps is a must. With the help of Open AI and ML, you can ensure that the app is capable of analyzing transaction data in real-time to identify and prevent any fraud.

Customer Support System

Build a responsive customer support system that provides assistance and promptly resolves users’ queries for a better customer experience. Your customers must be able to get quick answers to their questions through the app.

Money Remittance

The best advantage the audience gets from the FinTech apps is the quick money transfer. The FinTech app should also allow users to securely and efficiently transfer money domestically and internationally.

Basic Financial Transactions

The basic financial transactions feature should enable the users to securely transfer funds, make payments, and manage other transactions. Adding this feature will ensure efficient and reliable processing of monetary transactions.

Build a Solid App With Our FinTech App Developers at ValueAppz

At ValueAppz, we offer top-notch financial software development services for various FinTech needs. Our leading tech stack, interactive user interfaces, and pre-integrations will help you get the perfect FinTech solution for your business.

Build the best FinTech app at the right cost with our services. Book a consultation, get in touch with our experts, and get a free quote for your FinTech app solutions.

Key Takeaways

- Startups and small businesses can invest in various FinTech apps, such as banking, payment, investment, lending, and cryptocurrency.

- FinTech app development typically costs between $50,000 and $100,000, depending on features, design, and customization requirements.

- Successful FinTech apps need a user-friendly interface, secure authentication, comprehensive dashboards, QR-code payments, push notifications, and third-party integrations.

- Ensure robust security with biometric authentication, two-factor authentication, blockchain technology, and AI-driven fraud detection to protect user data.

Frequently Asked Questions

Q1. How to make financial software?

The steps for building FinTech software are as follows:

- Understanding the market

- Identifying the niche

- Choosing features and functionalities

- Designing the app

- Choosing the FinTech app development company

- Test and iterate the app

- Launch and market the app

Q2. Which software is best for finance?

Some of the best finance software are Zelle, Venmo, Coinbase, Brigit, and EarnIn.

Q3. How can finance software help businesses improve their financial operations?

Finance software helps automate processes, track transactions, control spending, and provide real-time financial data analysis, hence providing a great customer experience.

Q4. What are the essential features of finance software?

Some of the essential features of finance software are a user-friendly interface, fraud detection, third-party integrations, a comprehensive dashboard, and push notifications.

Q5. How much does it cost to develop finance software?

Building FinTech software costs between $50,000 and $1,00,000. The cost varies depending on the app’s features, design, and development team.

Q6. What are the benefits of using Artificial Intelligence (AI) in finance software?

AI in finance software helps enhance customer experience, automate repetitive tasks, enables fraud detection, and provides personalized recommendations.

THE AUTHOR

Priya

With 5 years of marketing experience under my belt, I bring a data-driven approach to my writing, creating content that is informative and actionable. I'm passionate about helping businesses achieve their marketing goals. Let's chat about how to make your product or service more user-friendly.

Get ready to digitally transform your business.

Let our team help take your business to the next level. Contact us today to get started on finding the perfect solutions for your business needs.